2021 45L Builder’s Tax Credit for Energy Efficient Homes

Did you know that you may be qualified for a tax credit of $1,000 or $2,000 for each “energy efficient” home you built in 2021?

If we completed the HERS Rating for your project, we can provide the required certificate for a modest fee. Check in with us with the project reference, and we’ll determine if your project qualifies. If the project does not qualify, there is no fee.

The qualifications for each credit are detailed below:

Qualifications for builders/manufactured home contractors to claim the $2000 credit:

Home sold or leased in 2021 tax year

Home achieves a 50% energy savings for heating and cooling over 2006 IECC

⅕ of energy savings must come from building envelope improvements

Home certified to meet these requirements by form 45L from eligible certifier

Qualifications for manufactured homes contractors to acquire the $1000 credit:

Home sold or leased on 2021 tax year

Home achieves 30% energy savings for heating and cooling over 2006 IECC

⅓ of energy savings come from building envelope improvements

Alternatively, home meets energy star requirements

Home certified to meet these requirements by form 45L from eligible certifier

The reason we want to let you know about these credits is because of the last bullet point in each of those lists. We are an eligible certifier, and if we performed your HERS ratings it is a simple process for us to provide you with that 45L documentation. We can process the tax credit for a modest fee.

A 45L report indicating your build meets the requirements for the credit looks like this:

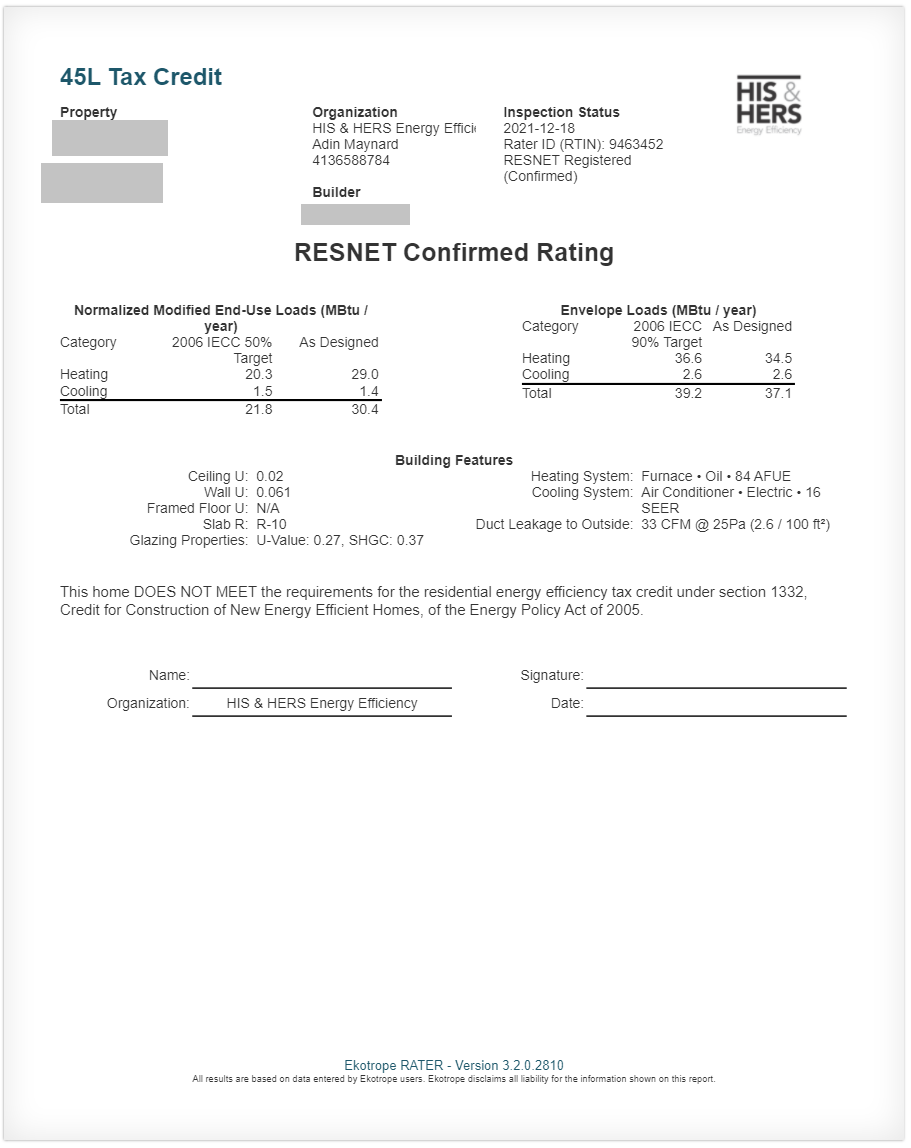

A 45L report indicating that your build does not meet the requirements looks like this:

If you would like to know if any of your projects are eligible for this credit, please get in touch! We love helping our clients take advantage of the financial incentives available to them that encourage the construction of energy efficient buildings.